EUR/USD

EUR/USD Weekly Forecast: Caution hits volatility, more action ahead

- Political turmoil paused this week, focus shifted to pandemic-related headlines.

- Minutes from the Fed and the ECB next week could bring back speculation.

- EUR/USD holds on to its long-term bullish bias, minor diverges appeared these days.

Market players took a cautious approach this week, leaving EUR/USD confined to familiar levels. For a second consecutive week, the pair is closing with modest gains above the 1.1800 level, as investors struggled to find a directional catalyst, despite the enthusiasm triggered by last week US data and the executive orders signed by US President Trump on fiscal stimulus.

Politics pause, coronavirus uproars

These days, the US Congress made no progress in the stimulus bill, meant to replace the one that expired on July 31. Also, there were no fresh news related to the US-China relationship, at least not those that could impress investors.

Regarding the ongoing pandemic, there are at least six promising vaccines in stage three of testing, and Russia even registered its own, despite tests are incomplete. However, the number of global new coronavirus cases has picked up, with Europe fearing a second wave is already there. In the US, the number of cases has stabilized above 50,000 new cases per day, although testing has receded, putting at doubt the headline number. Globally, the 7-day moving averages in new cases and daily deaths had picked up after being stable for most of July. Travel bans and localized lockdowns are hitting multiple economies, which means economic recoveries continue to be delayed.

The greenback, in the meantime, suffered a major setback mid-week after a record auction of US Treasury bonds sent debt lower and yields higher. Still, it fell short of moving EUR/USD away from its previous week’s range.

Within these scenarios, it is hard to decide, not which currency is the strongest, but the “less weak.” Speculative interest has chosen to remain sidelined ahead of some clearer clues.

Macro data hints a slow path to recovery

European data released these days failed to impress. The EU Q2 Gross Domestic Product was confirmed at -12.1% according to the second estimate, while German’s CPI remained depressed, meeting the previous readings in July. Industrial Production in the Union shrank in June, while the only encouraging figure was the German ZEW Survey, which showed that Economic Sentiment continued to pick up in August, although the assessment of the current situation deteriorated.

US data, on the other hand, was generally encouraging. Inflation beat expectations in July with the core annual reading improving to 1.6% from 1.2%. Also, Initial Jobless Claims fell to 963K in the week ended August 7, the first time below 1 million since the coronavirus pandemic took its toll on the economy.

The headline reading of July Retail Sales missed expectations, as sales were up by 1.2% in the month vs the 1.9% expected. Sales ex-autos, however, improved to 1.9%, while Retail Sales Control Group surged 1.4%, beating the expected 0.8%. Finally, the preliminary estimate of the Michigan Consumer Sentiment Index for August resulted at 72.8 from 72.5 in July, providing a modest lift to the market’s mood at the end of the week.

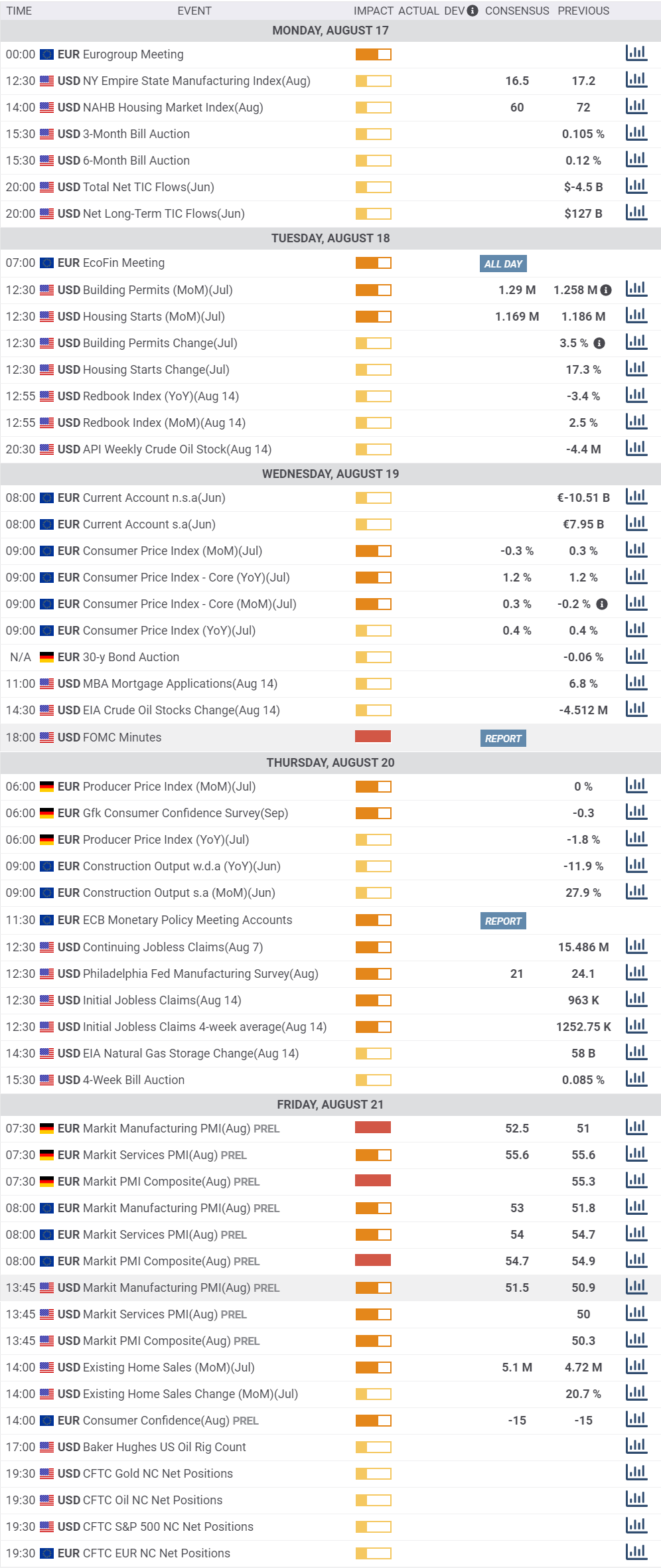

The upcoming week will bring little of interest until the end of it. Both the US Federal Reserve and the European Central Bank will publish the minutes of their latest meeting. On Thursday, speculative interest will focus on US unemployment claims after the nice surprise from these days. On Friday, Markit will publish the preliminary estimates of its August PMIs, expected to remain within expansion levels at both shores of the Atlantic.

EUR/USD technical outlook

The weekly chart for the EUR/USD pair suggests that the rally is not yet over. The pair is above the 23.6% retracement of its July/August rally at 1.1740, having briefly fallen below it. In the mentioned time-frame, the pair keeps developing far above all of its moving averages, with the 20 SMA aiming to surpass the 100 SMA, both below the 200 SMA. Technical indicators hold within overbought reading with uneven directional strength but without signs of upward exhaustion.

In the daily chart, a firmly bullish 20 DMA continues leading the way higher, providing dynamic support and now nearing the mentioned Fibonacci support. Technical indicators, however, are drawing some bearish divergences that are yet to be confirmed. The Momentum heads firmly lower within positive levels, nearing its 100 line. The RSI has retreated from its recent highs and is stable at around 65.

The first relevant support level is 1.1710, this week low, followed by the 38.2% retracement of the mentioned July/August rally at 1.1635. A break below this last could see the pair approaching the 1.1500 level before buyers re-appear.

The weekly high at 1.1863 is the immediate resistance ahead of the year’s high at 1.1915. Once beyond this last, the pair has room to extend its advance to 1.2000.

EUR/USD sentiment poll

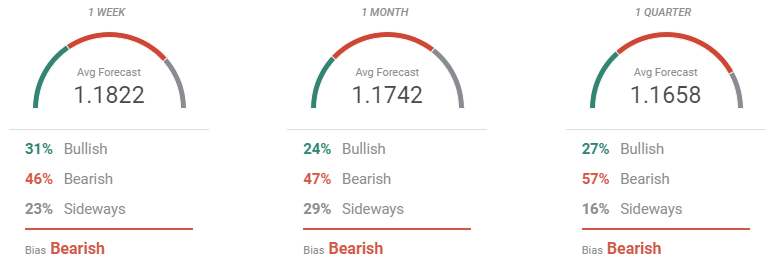

The FXStreet Forecast Poll shows that the market has turned bearish on EUR/USD, as those betting for a decline are a majority in all the time-frame under study. Even further, bearish interest increases as time go by, with 46% of the polled experts favoring declines in the weekly view and 57% in the quarterly perspective.

Most experts are seeing the pair ranging throughout August, with chances turning south afterwards. On average, the pair is seen at 1.1822 in the shorter-term, down to 1.1650 in the three-month view. In the Overview chart, moving averages have turned flat in all the time-frames under study.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come acro

Comments

Post a Comment